bear trap stock example

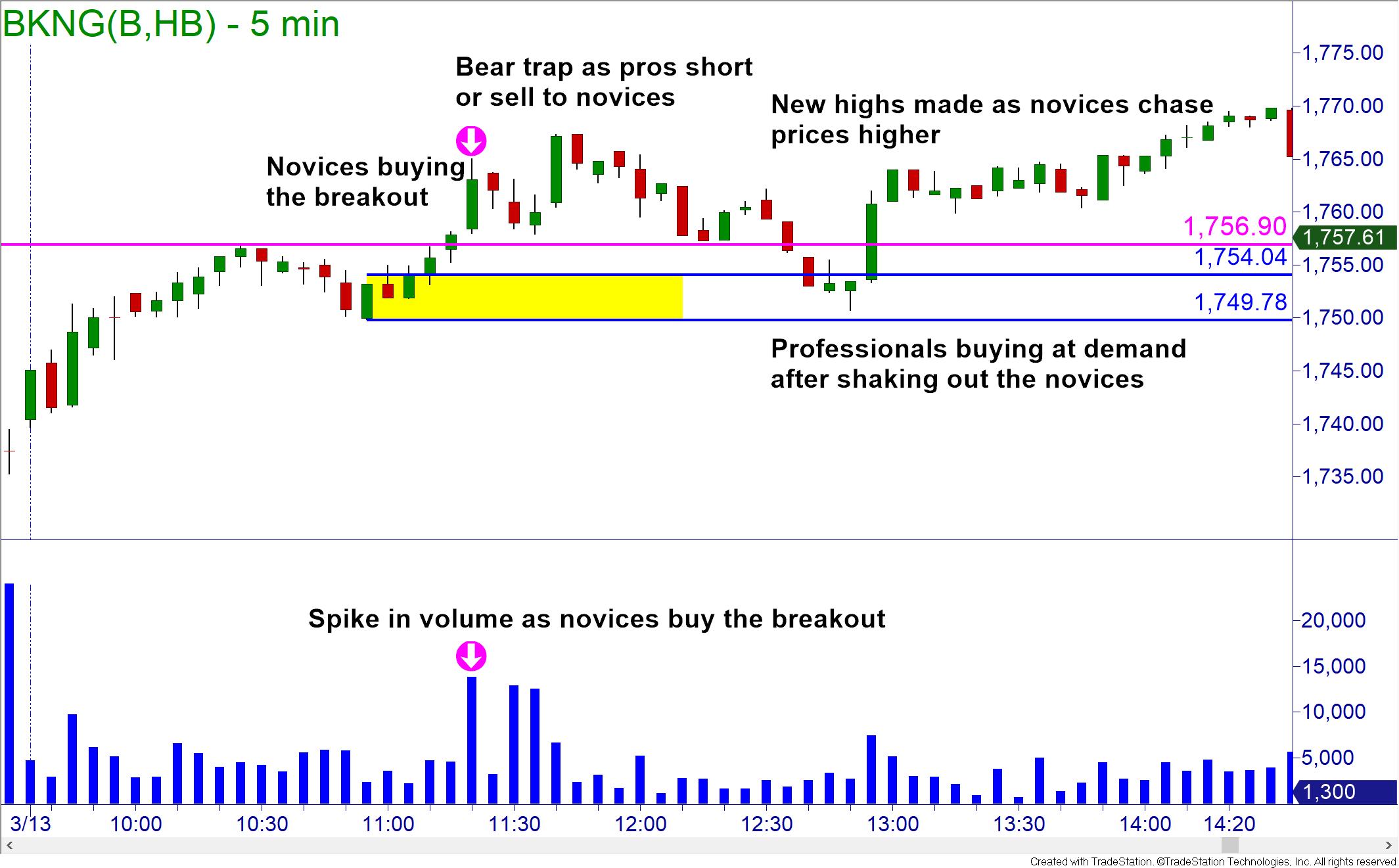

In the next example we can see a bear trap pattern. Bear traps occur when investors bet on a stocks price to fall but it rises instead.

Bear Trap Explained For Beginners Warrior Trading

A Bear Trap occurs when a stock that has been declining suddenly reverses and starts to rise.

. Bear trap example Suppose youve. Bear Trap Stock is a term used in the stock market to describe a particular type of investment. After the support is put in place just below.

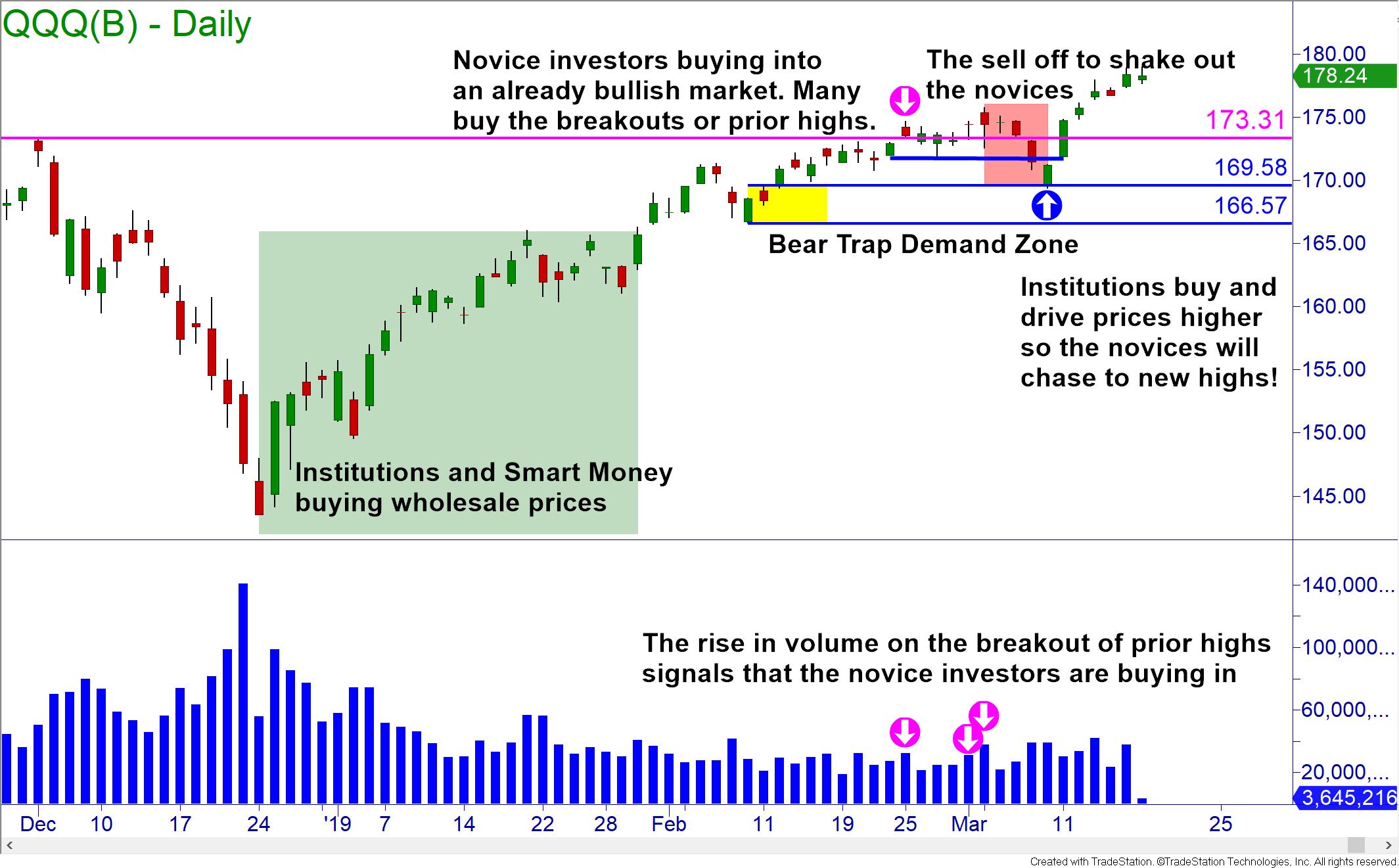

The bear and bull trap are created by the major market players. 3 Types of Candlesticks in Bear Traps 1. Example of trading the bear trap pattern.

You will notice that the stock broke to fresh two-day lows before having a. One such trap is the Bear Trap in Stocks. Bear Trap Stock Chart Example.

Ad Award-Winning Trading Software Best-in-Class Brokerage Services. Bear Trap Chart 3. A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively.

Example of a bear trap pattern. Cabot Wealth Network will make you a better investor. Rising stock prices cause losses for bearish investors who are now trapped.

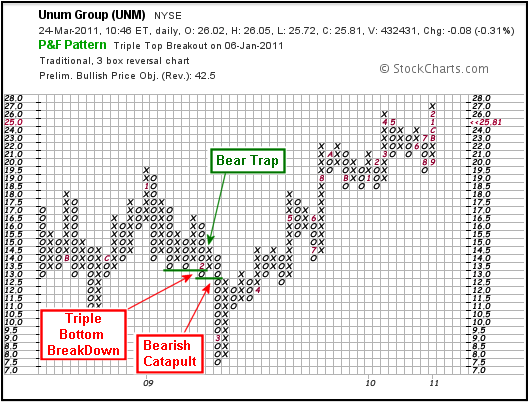

Below is an example of a bear trap on 76 for the stock Agrium Inc. For example when there are a lot of people. Bounce which will often precede the short-term top in the.

Notice from this chart that. Bear Trap Chart 2. Ad How To Trade Options will change how you invest your money - receive it today.

Bear Trap Chart Example. Bearish Candlestick Closing Above Support. For a bear trap chart example consider a scenario where traders were watching a key support level of 425 on the SPDR SP 500 ETF a.

Here price action moves sideways after a steady. Ad Powerful stock analysis since 1970. A Bear Trap in terms of trading is a strategy that institutions use to take advantage of the young traders that dont have the insight to recognise when they are being played.

In general a bear trap is a technical. The chart below is for the agricultural products and services retailer Agrium Inc. Ad Market News Just Got Easier to Navigate.

Below is an example of a bear trap on 76 for the stock. Markets move higher because of an imbalance between buying and selling pressure. To avoid the negative effects of a bear trap dont take a short position on a stock or sell your holdings just because the price has dropped.

Illustrated below is another bear trap example with a stock. Bear Trap Chart Example. Cabots free report will help you learn how to analyze charts trends and more.

Check Out Our Upgraded Website Experience Today. This is the prime example of a bear trap in financial markets. Illustrated below is another bear trap example with a stock.

Don T Get Caught In A Bull Trap Tips To Avoid Getti Ticker Tape

3 Bear Trap Chart Patterns You Don T Know

Bear Trap Best Strategies To Profit From Short Squeezes

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Best Strategies To Profit From Short Squeezes

What Is A Bear Trap On The Stock Market Fx Leaders

The Great Bear Trap Bull Trap Seeking Alpha

What Is A Bear Trap Seeking Alpha

Bear Trap Best Strategies To Profit From Short Squeezes

What Is A Bear Trap On The Stock Market

Bear Trap Stock Trading Definition Example How It Works

P F Bull Bear Traps Chartschool

Bear Trap Best Strategies To Profit From Short Squeezes

What Is A Bear Trap On The Stock Market

Bull Traps Vs Bear Traps How To Trade With Them Phemex Academy

What Is A Bear Trap On The Stock Market Fx Leaders